News

Flat Stable ToursMore Stable Tours

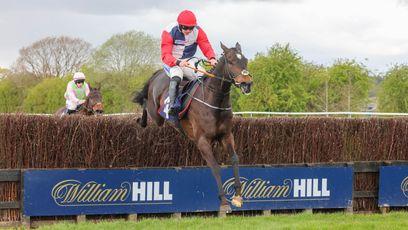

BritainMore British racing news

IrelandMore Irish racing news

InternationalMore international news

Reports More reports

OpinionMore opinion

InterviewsMore interviews

The Last WordThe Last Word

Industry NewsMore industry news

Maddy MeetsMore video