Prize-money: how Britain has been left trailing by the rest of the world

Jonathan Harding compares prize-money funding models around the globe

This special report is available as a free sample. To get more great articles and insight from our award-winning team of journalists, join Members' Club Ultimate here.

Prize-money is the lifeblood of racing, but there are growing fears the returns on offer in Britain are not nearly enough to maintain its position as a world-leading centre of the sport.

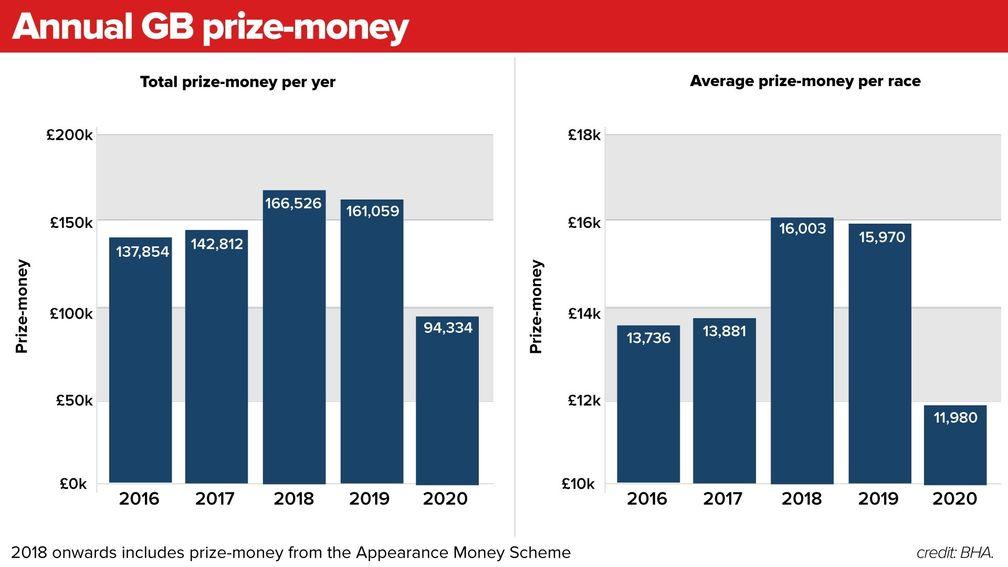

According to Racecourse Association (RCA) figures, owner expenditure was £621 million in 2019 but there was only £161m in total prize-money up for grabs, meaning returns would have had to increase many times over just to cover costs.

Perhaps inevitably, therefore, recent months have been punctuated by tales of owners deciding to scale back their investment, trainers looking beyond Britain or packing up for good, and many industry figures warning of a spiral of decline if the sport doesn't take urgent measures to increase its appeal to prospective owners.

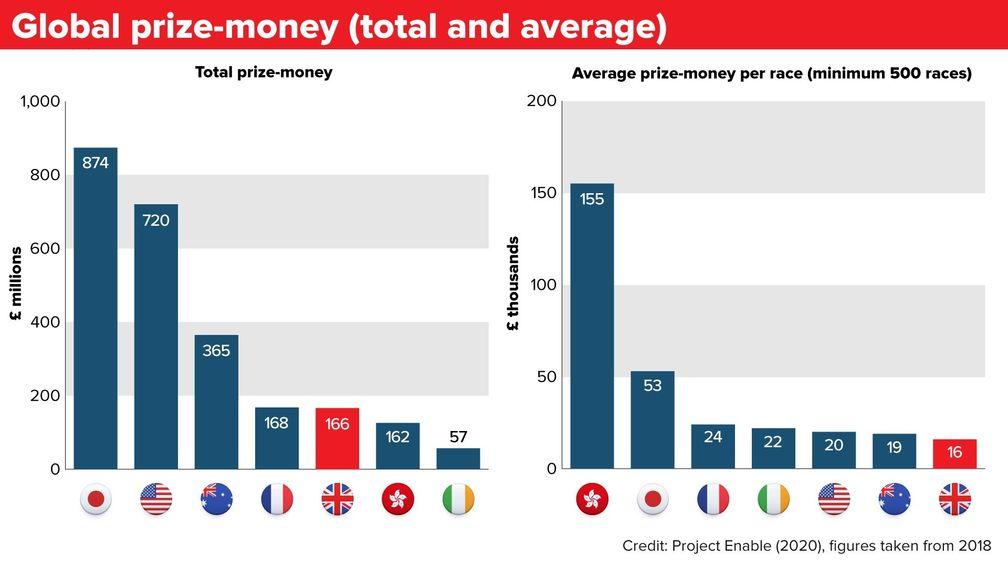

And prize-money comparisons across the world emphasise just why British owners and trainers feel so dissatisfied.

Figures compiled as part of Project Enable, a commercial review of the sport, showed the average prize-money offered in Britain was less than Ireland, Australia, Japan, Hong Kong, France and the US in 2018 at £16,003 per race. This decreased to £15,970 in 2019 before falling to £11,980 due to the financial implications of the pandemic.

So what is it about the way prize-money is funded that means Britain is unable to offer the same rewards as other racing nations?

The British model: three streams

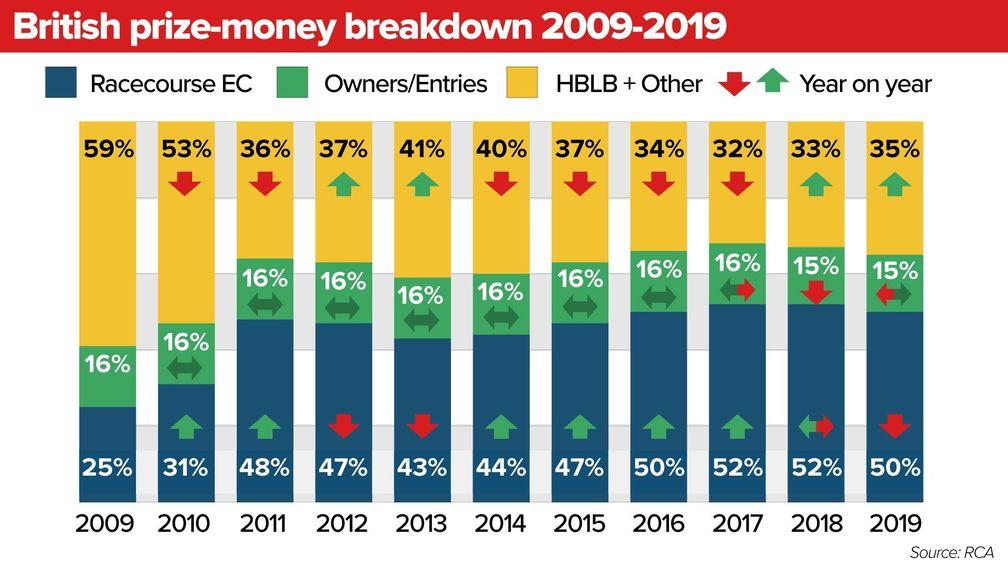

Prize-money in Britain is funded by three streams. In 2019 funding from the levy – a ten per cent tax on bookmaker racing profits – provided 35 per cent. This encompasses fixed-odds betting and the Tote, a pool betting service whose on-course operation is run alongside Britbet.

When the UK Tote Group acquired the Tote from Betfred in 2019, it promised to pay the sport at least £50m over seven years, alongside its levy obligations. The Tote under Betfred paid out more than £80m in seven years but operated under different agreements.

Owners' entry fees made up 15 per cent of the prize-money offered in 2019, while the remaining 50 per cent came from executive contributions by racecourses. These are partly funded by spectators, who ordinarily provide roughly half of tracks' collective income, and are also linked to sponsorship and media rights payments.

A perceived lack of transparency over the latter is a frustration for some participants, who would like more say over such agreements. Indeed, the arguments have come to a head in recent weeks with some owners suggesting the financial health of Arena Racing Company (Arc) tracks was not reflected in their purses. On the other hand, executive contributions from racecourses did double as a percentage of the total prize pool from 2009 to 2019.

Since March 2020 racecourses have missed out on an estimated £400m in revenue. This was notably reflected on the biggest stages as the returns from Britain's top ten Flat races last year fell to just £3.8m, a 64 per cent decrease from 2019, while the Derby was worth £500,000, down from £1.6m.

The BHA announced the return of minimum prize-money figures to pre-coronavirus levels when it published its fixture list in February, with the Levy Board's contribution nearly 50 per cent higher.

The Levy Board made a financial commitment to shore up prize-money totals in May and June, underpinned by increased racecourse contributions, and will boost its contribution by 40 per cent in July and August. Its income for the last financial year is expected to be £80m, which promises to provide some additional flexibility.

Ireland: government funding

The domination of Irish-trained runners at the big British jumps fixtures was well documented and, in the following inquest, the healthy prize-money levels in Ireland was a major talking point.

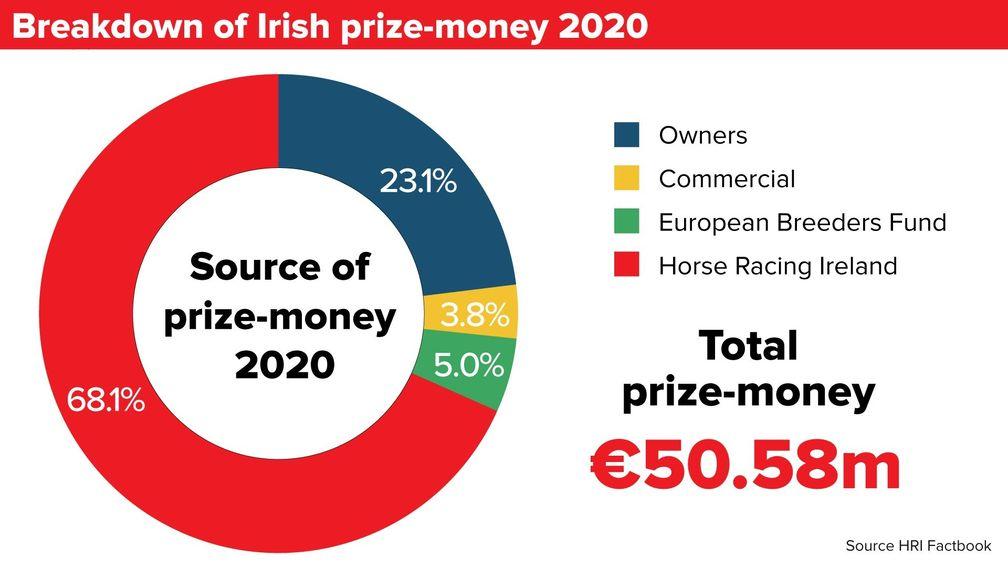

Irish racing receives contributions from the government exchequer, which funds the sport's governing body, Horse Racing Ireland. In 2020 contributions from HRI made up 68.1 per cent of prize-money.

HRI's funding that year was unchanged at €67.2m, largely due to the uncertainty surrounding Brexit, but its 2021 funding was increased by 14 per cent to €76.8m, which will help the industry weather the storm before the return of crowds. Minimum prize-money levels have now been restored to €10,000 per race.

The betting model in Ireland is similar to Britain, with a combination of fixed-odds betting and pool betting, but there is no direct, formal link between betting tax and government funding. However, it is accepted there is an association, and uplifts in betting tax revenue, such as when the tax was set at two per cent in 2019, have helped.

While Irish racing receives media rights payments, the money is ultimately used to maintain the track's own finances. Exact figures are hard to verify, but they are thought to be worth €7,000 a race.

France: PMU monopoly

Media rights payments are not a major contributor to prize-money levels in France as France Galop co-funds the racing channel Equidia with Le Trot, trotting's government body. The country misses out, however, on the broader mainstream coverage offered in Britain and Ireland.

Ticket sales are not a major revenue driver either, partly because entrance fees are low outside the big days and France Galop owns the major tracks, such as Longchamp, Deauville and Chantilly.

Some revenue is generated through sponsorship and corporate hospitality, but these are not a commercial imperative because prize-money is essentially underwritten by the profits of the Pari Mutuel Urbain (PMU), the third-largest pool betting service globally.

Of its total turnover, 75 per cent is returned in winning bets, nine per cent goes to the government through tax and eight per cent is split between France Galop and Le Trot, the two major shareholders – in 2019 €760m was returned to racing and trotting, which covered not only prize-money but the cost of staging the sport. The remainder is spent on PMU outgoings and paying commercial partners.

Without fixed-odds betting the wealth of the PMU ensures purses at lower and intermediate levels are better than anywhere else in Europe. The PMU also contributes to generous premiums of up to 70 per cent to winning owners of French-bred horses, regardless of where the owner is based.

For example, Sottsass won €857,100 for landing the 2019 Prix du Jockey Club, plus an extra €203,904 in premiums, while the Hughie Morrison-trained Marmelo won €31,827 on top of €74,100 for winning the Group 2 Prix Maurice de Nieuil in 2018.

French authorities are aware of the financial advantage they have over their nearest neighbours, and investments in a new woodchip track for the main training centre at Chantilly was followed by a €1.5m redevelopment of the training facilities at Maisons-Laffitte.

The message could not be clearer to trainers considering a wholesale move or setting up a satellite operation, and a number of British handlers have already taken advantage, including Tom George, whose son Noel runs their satellite yard in Chantilly. The stable has sent out five winners from 32 runners and has won more than €150,000 this calendar year.

Australia: pool betting perks

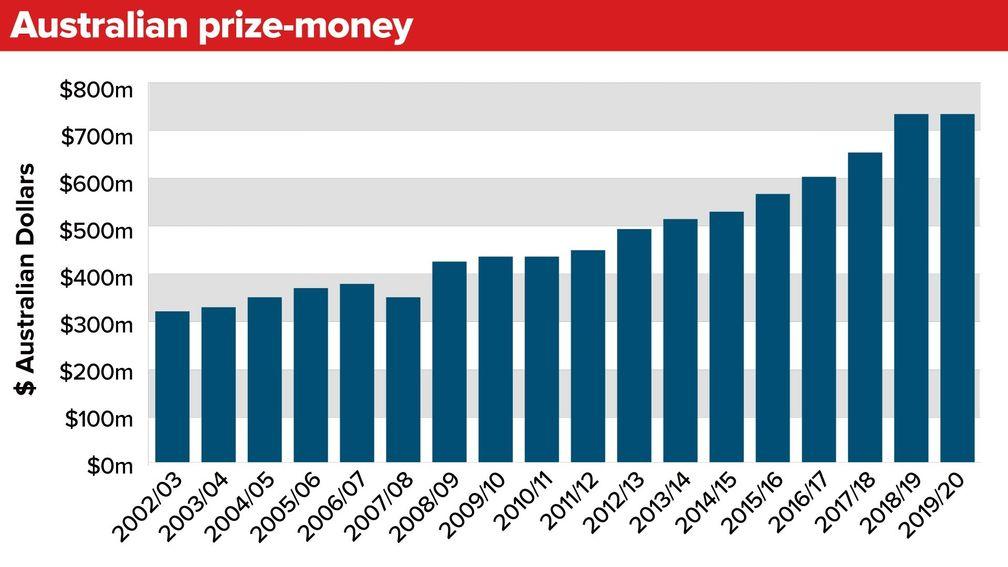

Australia is held up as a shining example of how an industry can maximise its profits, and this is reflected in its prize-money, which has increased by a staggering 84 per cent during the last decade.

In 2018 Australia offered more than the equivalent of £350m in prize-money – second only to Japan and the US – spread across 20,000 races, with healthy purses at every level of the sport.

The industry was on an upward trajectory before the beginning of the pandemic in the final few months of the 2019-20 season, which ran as always from August 1 to July 30, and prize-money actually increased from A$728,809,559 the previous year to A$730,769,073.

One of the strengths of Australian racing is its funding model. It is less reliant on sponsorship deals and owner contributions than other jurisdictions, the latter making up just four per cent of prize-money.

Instead, prize-money is primarily funded by punters through betting tax, the amount of which varies from state to state and via different agreements. There is a higher proportion of pool betting in Australia than fixed-odds betting, provided by the country's largest bookmaker Tabcorp, who pay more tax in exchange for exclusive retail wagering.

Prize-money levels also vary between states. Racing New South Wales announced a A$20m annual prize-money boost earlier this year after increased levels of betting turnover.

Hong Kong and Japan: complete control

Hong Kong and Japan are able to offer the most lucrative returns globally because they benefit from centralised funding models.

The Hong Kong Jockey Club (HKJC) runs the entire operation, with all bets being placed through the governing body. As such, prize-money is almost entirely funded by betting turnover.

Hong Kong residents can legally bet only on racing and football, and the benefits of engaging a captive audience are reflected in its betting turnover, which is expected to reach a record HK$133 billion (just over £12bn/€14bn) for the 2020-21 season.

Of that figure, betting duty of 12 per cent is paid to the government, making the HKJC Hong Kong's biggest taxpayer, and 4.3 per cent is retained by the club to cover operating costs, sizeable charitable contributions and prize-money, around HK$1.4bn (£128m/€145m) overall, spread across 88 meetings at Sha Tin and Happy Valley.

A similar model was adopted in Japan, where the Japan Racing Association (JRA) is responsible for meetings at major tracks in metropolitan areas, such as Tokyo, and the National Association of Racing (NAR) coordinates various local fixtures nationwide.

The JRA does not rely on sponsorship deals or media rights to finance its astronomical prize-money as it is derived from betting turnover, which actually increased last year despite Covid-19 severely impacting on-course attendances; online betting boomed as racing continued largely uninterrupted during the pandemic.

Of this betting money, 25 per cent is deducted by the JRA, out of which two-fifths goes to the national treasury and the rest to racing, including for prize-money, which increased to ¥119,538,495,110 (£775m/€897m) last year from ¥115,969,435,491. Some maiden races for newcomers are worth ¥5m (£32,000/€37,000).

The healthy returns in Asia are significant as it means owners can afford to buy a lot of top European and Australasian horses, stoking fears Britain could become even more of a nursery for those jurisdictions than it is already.

What next for Britain?

Global prize-money success stories provide compelling templates for how to fund a thriving racing industry. The problem is that, in many cases, it looks almost impossible for Britain to replicate such models, with major political and legal obstacles in the way.

For instance, government contributions via HRI are key to the generous prize-money in Ireland, but there would be state aid issues with the application of the Irish model in Britain, and the likelihood that other sports would want similar treatment makes it extremely unlikely that any British government would agree to it even if there was the political will.

And while jurisdictions like Japan, France, Australia and Hong Kong reap their rewards through Tote/PMU betting, that would require a huge overhaul of the betting industry in Britain, which is unlikely to be on the agenda any time soon. The gambling environment is very different to the likes of France and, again, it is highly unlikely that any government would wish to radically interfere in the market to such an extent.

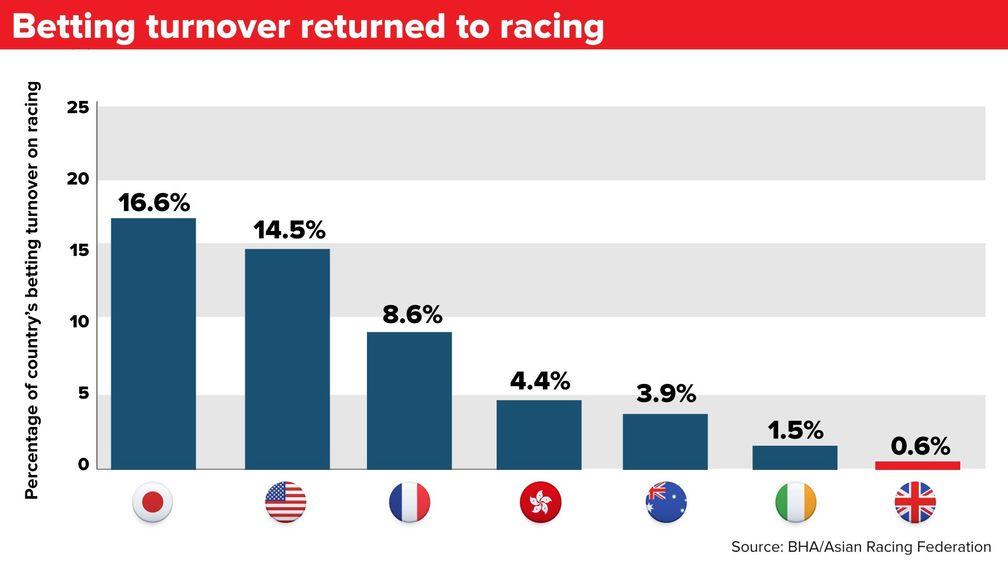

However, the way racing is funded so much more directly through betting in other jurisdictions suggests this is the key area for the future of British racing. Just 0.6 per cent of betting turnover in Britain is returned to racing at the moment, compared to 1.5 per cent in Ireland and much higher rates across the rest of the world.

This huge discrepancy suggests the lack of money coming into the sport through betting turnover is the main reason for Britain's poor prize-money compared to the rest of the world and emphasises the need for British racing to push for change in this area, even if it has to be on a smaller scale.

There has long been an ambition to bring forward the next stage of levy reform to broaden its scope to bets placed on overseas racing, which could raise more than £30m in extra income annually. There are also growing calls for further reform to change the basis of the levy from bookmaker gross profits to turnover, or perhaps a hybrid model, which it is claimed could raise tens of millions more.

Whatever the solution, British racing cannot afford to stand idly by and slip further behind its competitors. Without change, the industry risks not only an exodus of owners but further damage to its global standing.

Read more on prize-money in Britain:

Prize-money boost as £4m to be on offer again at British Champions Day

Levy Board to boost support for prize-money by 40 per cent in July and August

Horsemen's Group and Arc in 'collaborative' talks despite prize-money row (Members' Club)

Owners wrong to wage war on racecourses – but transparency is desperately needed (Members' Club)

The Front Runner is our latest email newsletter available exclusively to Members' Club Ultimate subscribers. Chris Cook, a three-time Racing Reporter of the Year award winner, provides his take on the day's biggest stories and tips for the upcoming racing every morning from Monday to Friday

Published on inSeries

Last updated

- 'They make you realise how fun owning a racehorse is' - what's it like to be part of Pompey Ventures?

- Rogues Gallery Racing: what is it like to be part of the Royal Ascot-winning syndicate?

- We believed Dancing Brave could fly - and then he took off to prove it

- 'Don't wind up bookmakers - you might feel clever but your accounts won't last'

- 'There wouldn't be a day I don't think about those boys and their families'

- 'They make you realise how fun owning a racehorse is' - what's it like to be part of Pompey Ventures?

- Rogues Gallery Racing: what is it like to be part of the Royal Ascot-winning syndicate?

- We believed Dancing Brave could fly - and then he took off to prove it

- 'Don't wind up bookmakers - you might feel clever but your accounts won't last'

- 'There wouldn't be a day I don't think about those boys and their families'