The Big Punting Survey: one in six have already been hit with affordability checks

The Big Punting Survey part two: revealing racing's 'Radio 4 problem'

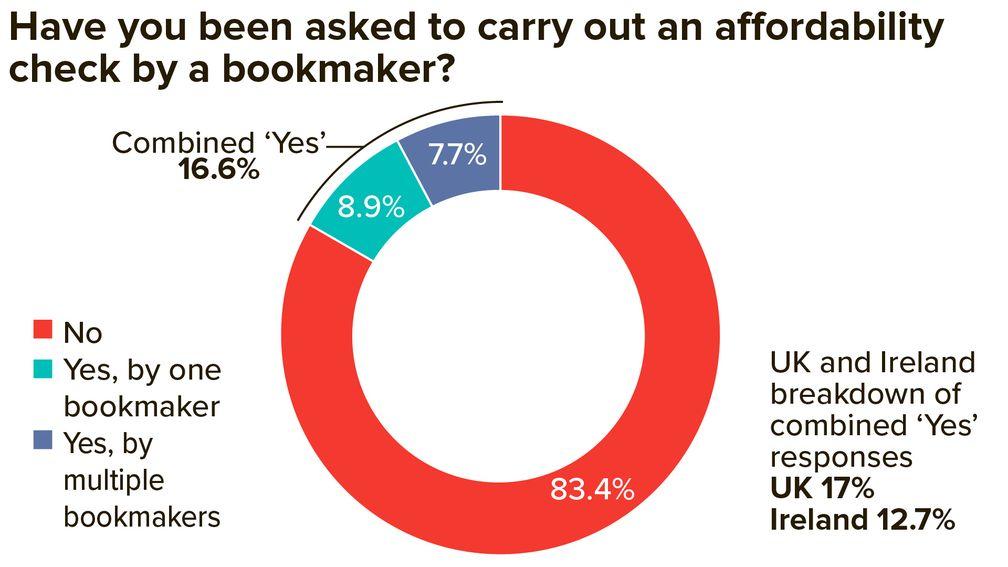

The scale of affordability checks on punters has been laid bare after a major Racing Post survey revealed one in six respondents (16.6 per cent) have already faced requests to hand over payslips and bank statements to at least one bookmaker, suggesting that tens if not hundreds of thousands of racing bettors have been affected by the controversial financial probes.

While anecdotal evidence has been mounting for months that betting operators have been compelled by the Gambling Commission to act on affordability in advance of the British government's long-delayed gambling act review, the news that so many punters had been asked to provide proof of means is a sobering statistic for racing, which has repeatedly warned the unpopular checks are driving punters away from the sport.

The Big Punting Survey garnered more than 10,400 responses – over 9,000 from Britain and close to 1,000 from Ireland – and looked at a wide range of issues affecting bettors.

The picture that emerges is likely to be of serious concern to both those charged with gambling regulation and those who govern racing, the finances of which are linked inextricably to betting.

Of the 16.6 per cent who have been asked for proof that they can afford their current level of betting activity, nearly half had seen financial checks from more than one operator (7.68 per cent). And the reaction to the emergence of affordability checks paints a bleak picture for the future of levy funds and media rights flowing into racing.

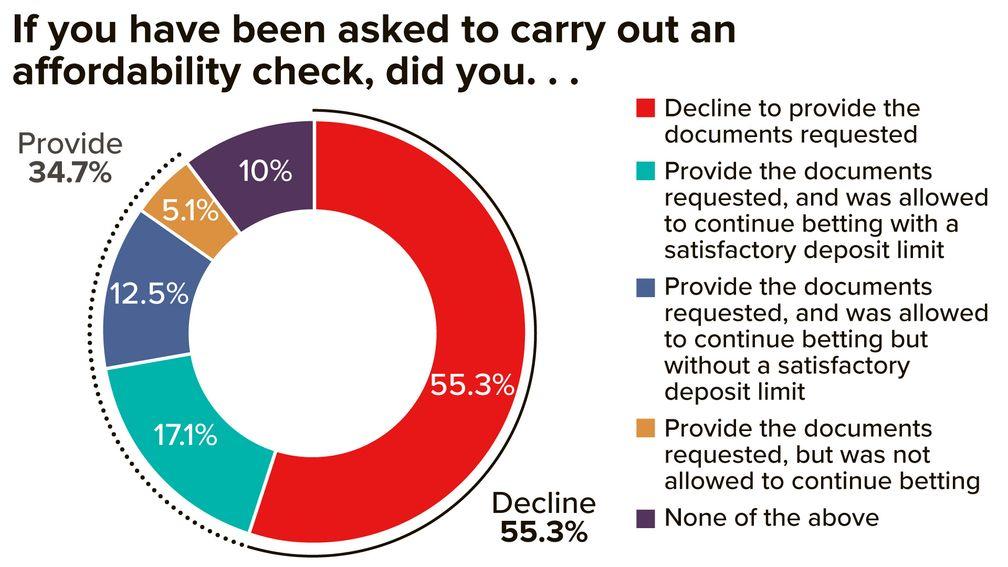

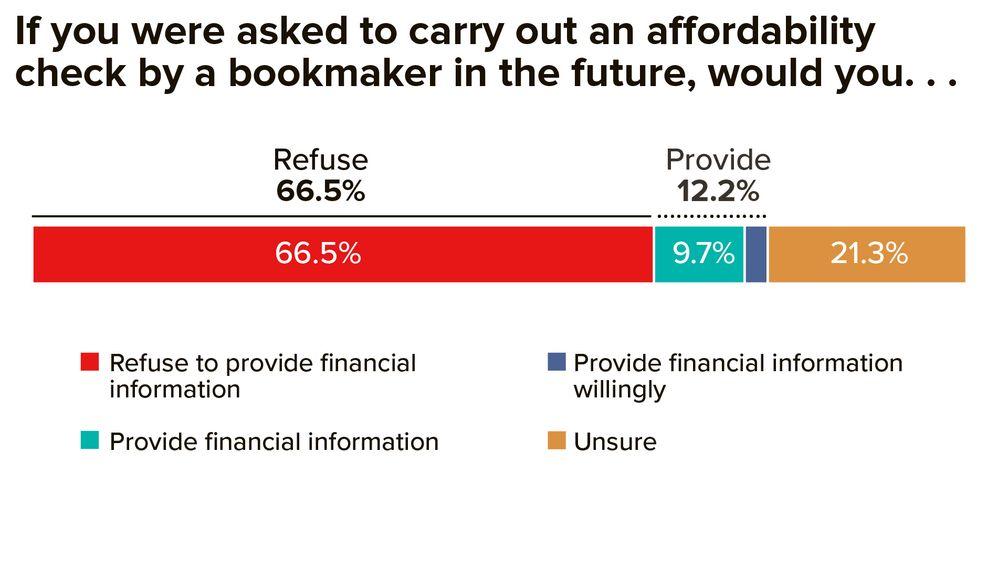

55.3 per cent of those asked refused to hand over documentation, while of the 34.7 per cent of respondents who complied, more than half either had a staking limit imposed on them with which they were dissatisfied (12.49 per cent) or had their account frozen (5.14 per cent). And of those yet to be confronted with requests for proof of means, two-thirds (66.52 per cent) said they would refuse, while another 21.29 per cent were unsure. That leaves just 12.19 per cent who said they would comply, albeit almost all of them said they would do so "reluctantly" rather than "willingly".

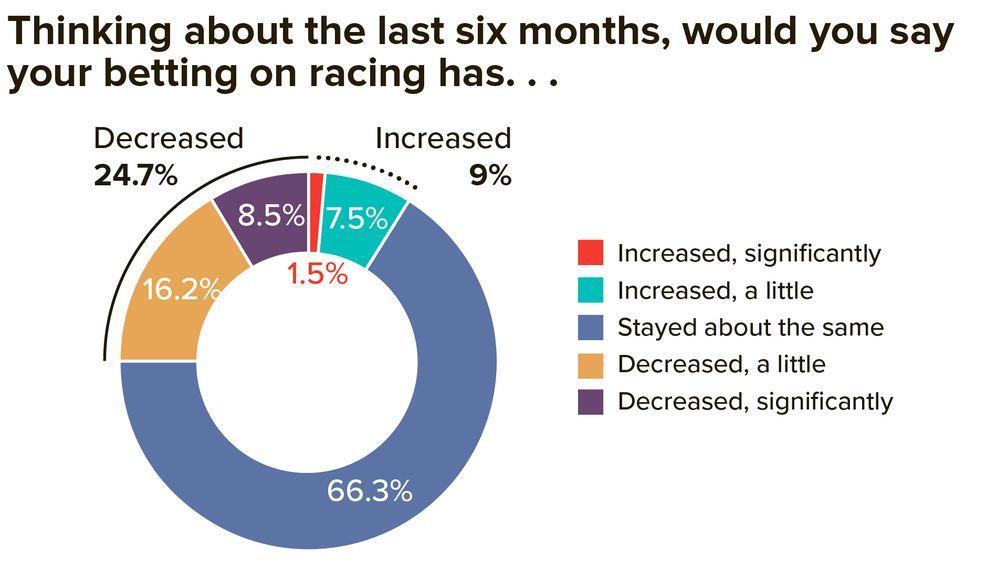

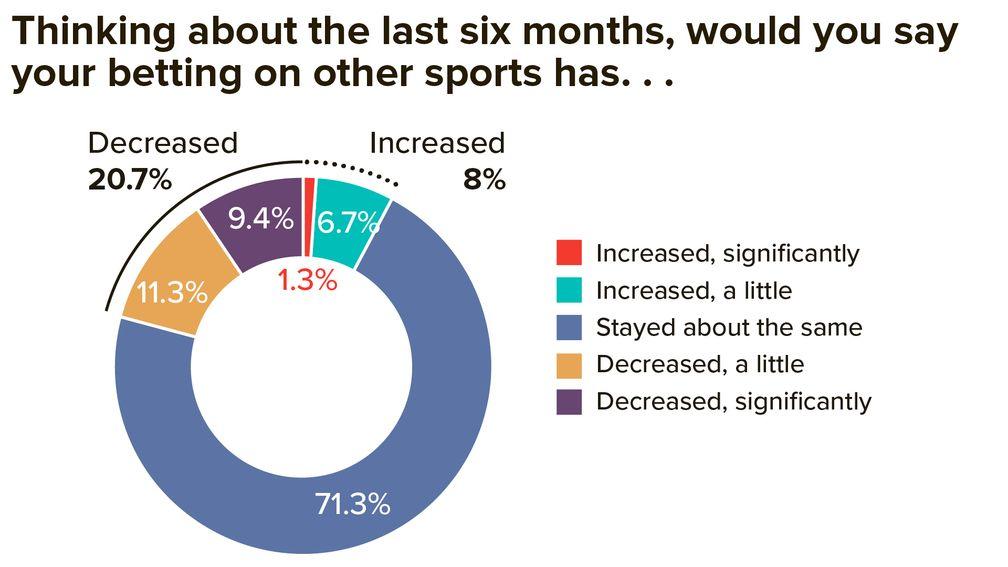

Perhaps unsurprisingly, one in four people surveyed said that their betting activity on racing had declined "a little" or "significantly" in the last six months. While some of that can be attributed to racing-specific problems such as weak field sizes, the equivalent figure across all sports (20.67 said that had declined "a little" or "significantly") points directly to the combined impact of affordability and the cost of living crisis.

Even among those surveyed in Ireland, where plans to introduce affordability checks have been dropped, the interconnected nature of the gambling industry across the two countries means that 12.63 per cent of people have been asked for documentation.

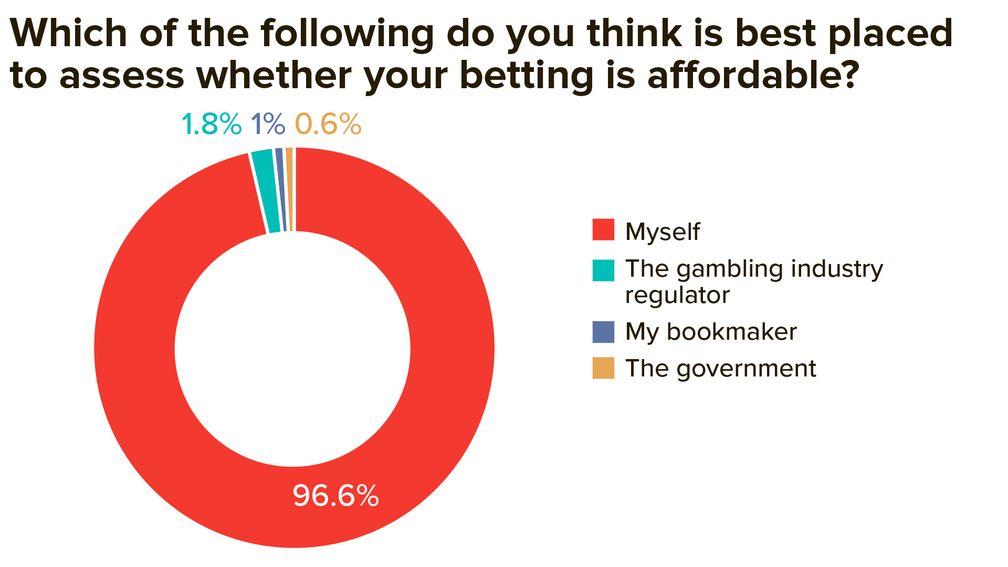

One more unsurprising but overwhelming statistic demonstrating the strength of feeling around affordability checks was that 97 per cent of the survey respondents feel they are best equipped to judge what they can afford to gamble, rather than the regulator, their bookmaker or the government.

Affordability: four in ten high earners are targeted

Proponents of affordability checks say they are needed to protect the vulnerable from gambling beyond their means (for context, the Gambling Commission’s most recent survey puts the problem gambling rate at 0.2 per cent of the adult population in the UK) and that regular participants who exhibit no signs of problem behaviour or addiction have nothing to worry about.

The survey figures demonstrate otherwise, with half of those who have actually responded to affordability checks still facing restrictions on their betting.

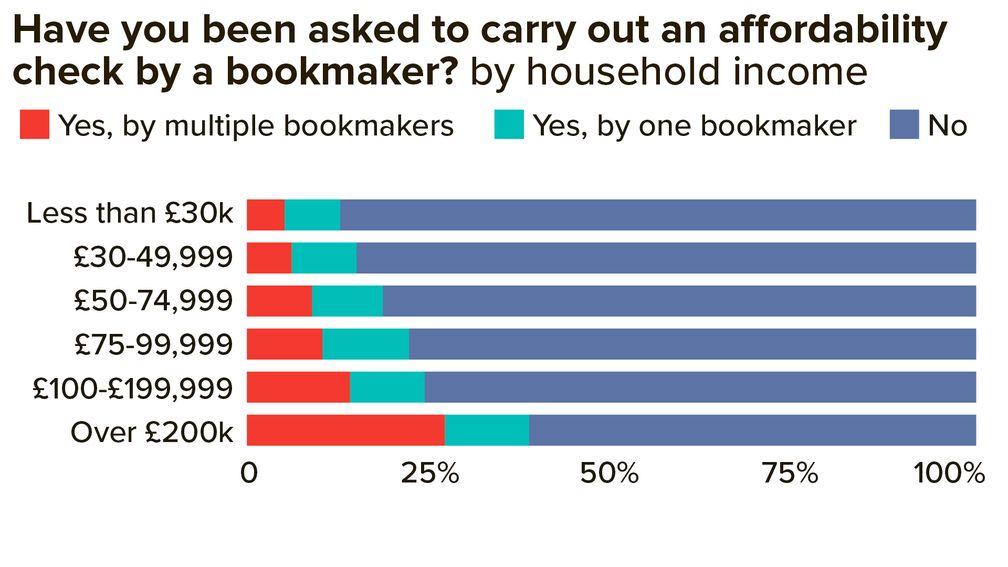

When broken down by income, level of stake and age, the figures shed further light on how affordability checks are working in practice.

While the overall proportion of respondents who have been asked to carry out affordability checks was 16.6 per cent, those with household income below £50,000 are less likely to have encountered financial queries.

Respondents with annual household income under £30,000 a year recorded an affordability check rate of 12.76 per cent, a figure which rises to 15.02 per cent for those with earnings of £30-49,999.

Compare that to the top two wealth brackets, with those from households earning £100,000-199,000 asked for proof they could afford to bet at a rate of 24.35 per cent, while 38.69 per cent of those on £200,000 plus were challenged about their finances.

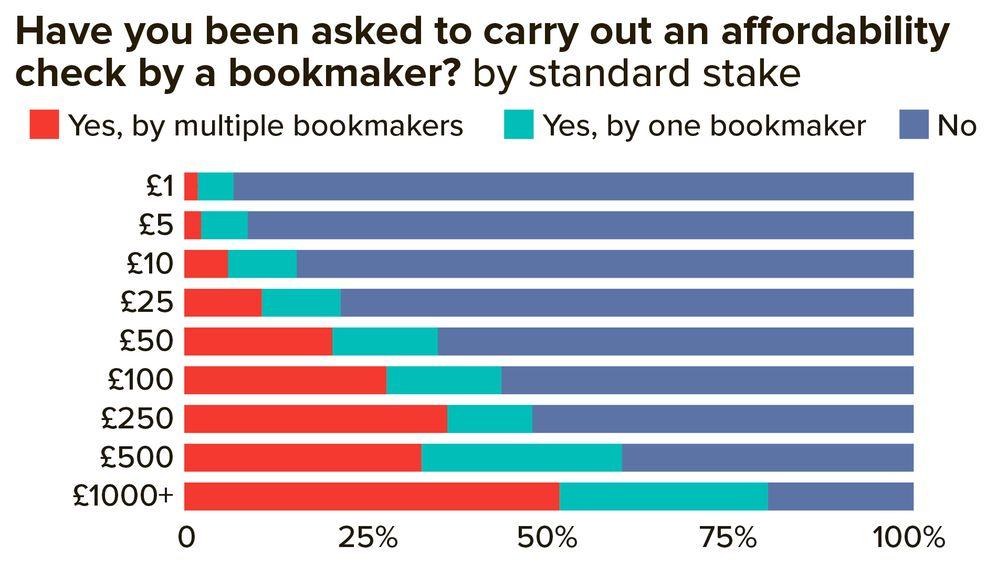

While those with greater wealth might be expected to bet to higher stakes, and therefore hit the thresholds which trigger checks more often, it is not just high rollers who are having in contend with affordability. In fact, a punter who places on average £25 on a race is currently running a significantly increased risk of being asked to undergo affordability questions.

Those whose regular single stake is £1 or £5 encounter checks at rates of 6.75 per cent and 9.68 per cent, while 15.4 per cent of those betting at £10 a race have been asked for financial documents.

That rises to 21.39 per cent at stakes of £25, while almost half (47.67 per cent) of those betting £250 a race have to provide documents. Of those who bet in units of £1,000 plus, four in five have already been caught up in checks.

The results will add to fears that an increase in staking at the Cheltenham Festival could bring far more punters within the scope of affordability programmes.

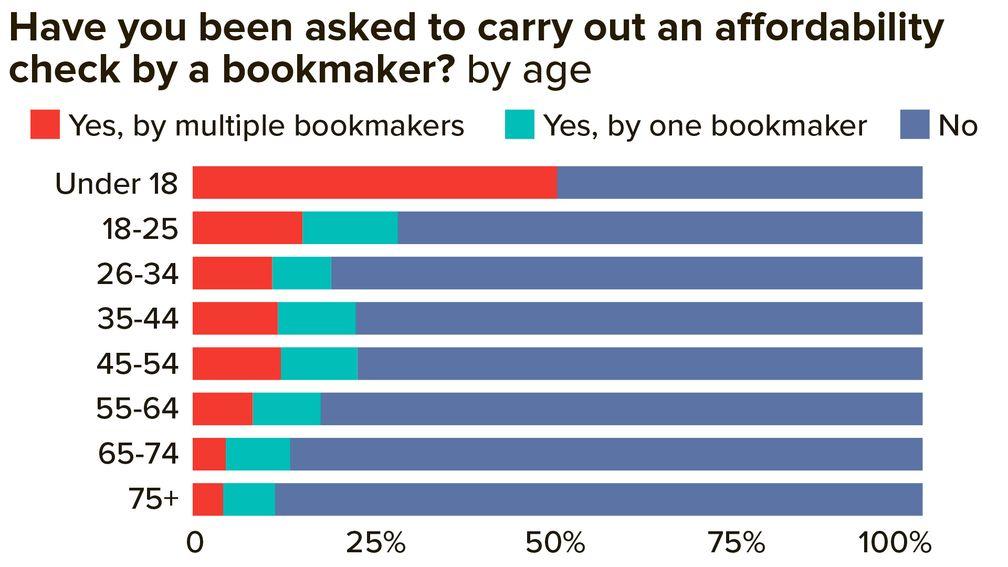

The final group that faces increased scrutiny is the young. 27.96 per cent of racing punters aged from 18-24 have been asked for proof of earnings, while the next three age brackets face checks at a higher clip than the 16.6 per cent total.

The black market: a growing threat?

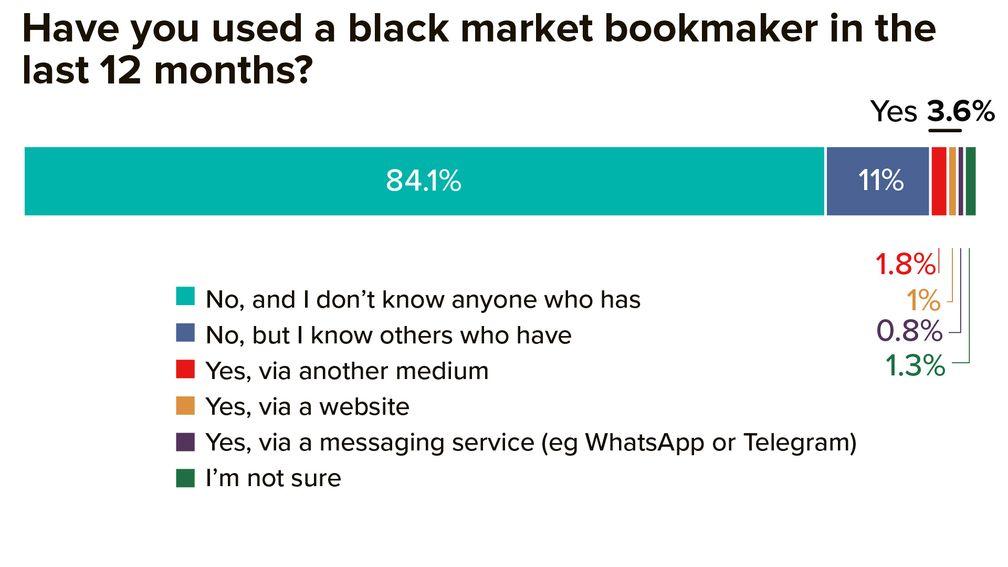

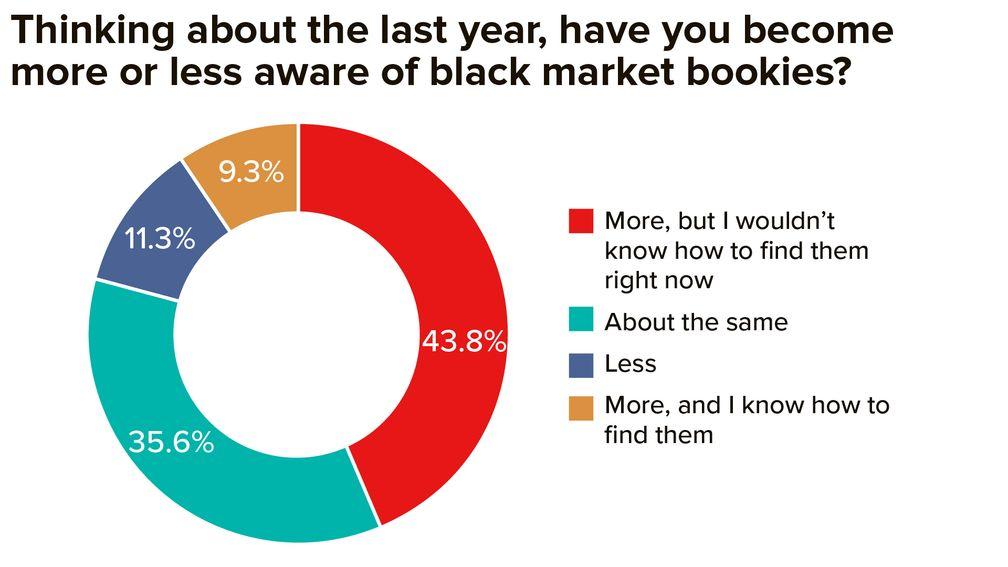

The headline figure for those in our survey that have used a black market bookmaker in the last 12 months was 3.6 per cent, while a further 11 per cent knew someone else who was betting via unregulated sources.

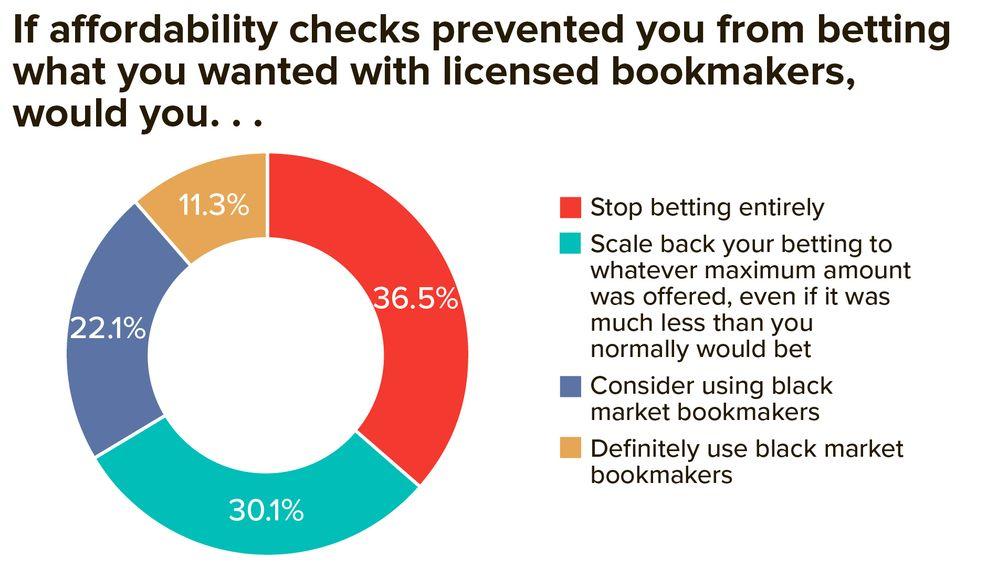

We also asked bettors what they would do if they were unable to bet what they wanted with regulated bookmakers. More than one third (36.48 per cent) said they would cease betting entirely, while another third would either consider turning to the black market (22.11 per cent) or definitely take that option (11.29 per cent).

Only 30 per cent said they would scale back their betting activity to comply with imposed deposit or staking limits.

Those figures cannot be taken as a cast-iron forecast of how people's habits will change, but they illustrate the potential financial black hole facing both the racing industry and the treasury, and the risk posed by the mixture of unpopular affordability checks and a readily accessible black market.

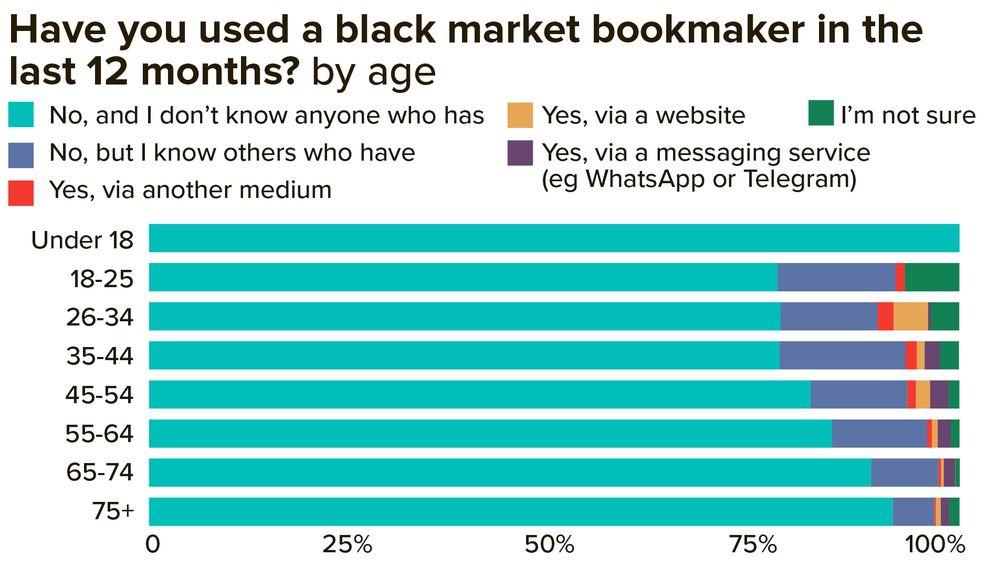

The segmented responses by age and size of stake show that the danger of a chunk of Britain's gamblers going outside the system is not to be taken lightly.

Those who say they have already used black market alternatives tend to be younger and/or stake at higher levels.

On the age front, the tech-savvy group between 26 and 34 years old responded yes to the question about using black market sources in the last 12 months at an overall rate of 6.59 per cent.

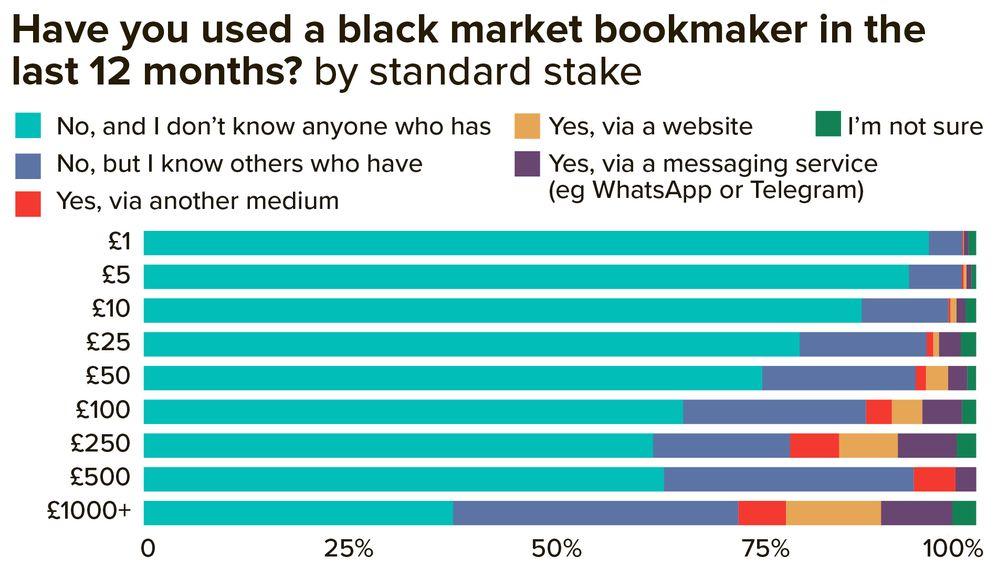

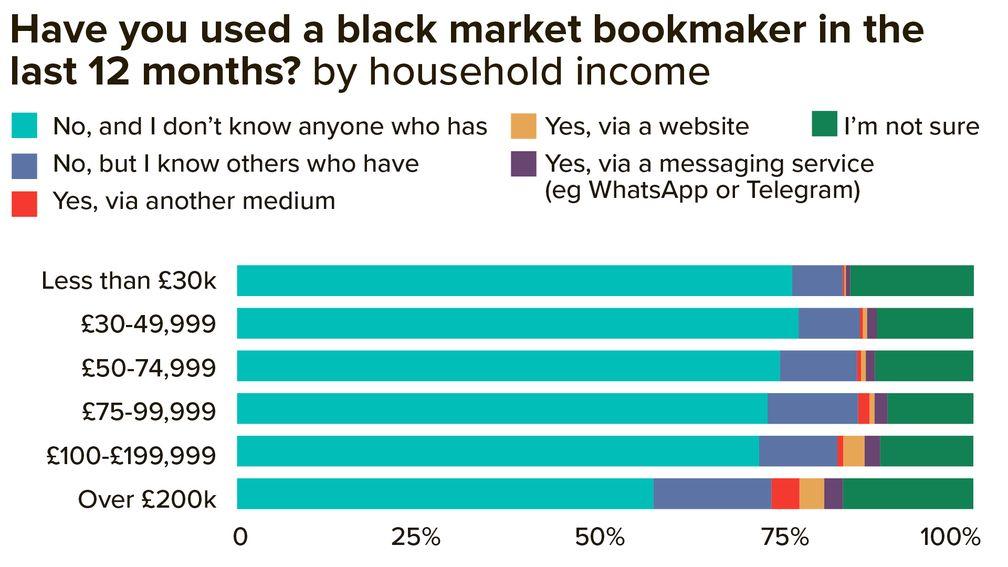

The pattern with both annual income and size of average stake is that the bigger the number, the more likely a person is to have used a black market bookmaker.

9.71 per cent of those with a household income of more than £200,000 have used the black market in the last 12 months, while the figure is above 7.5 per cent for every staking level over £100, and a striking 25.71 per cent for those betting at the level of £1,000 plus, illustrating the degree to which high rollers have already abandoned the regulated sector, with predictable consequences for racing's finances.

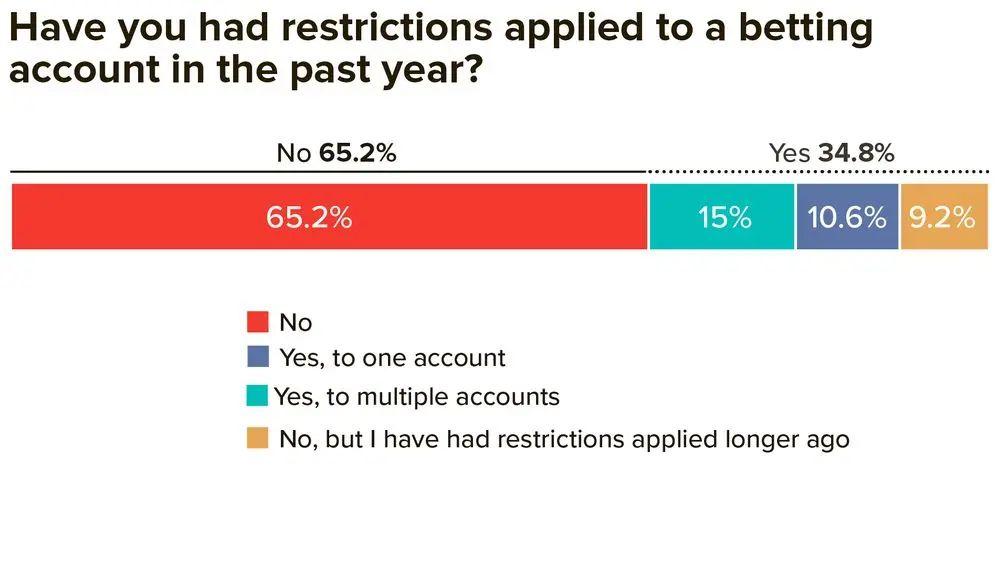

Betting restrictions on winning punters will also play a role in driving bettors outside the regulated sector: almost 26 per cent of respondents said they had had restrictions applied to an account in the last year (though this total will include affordability-related curbs) and a similar number have had a betting account closed at any point in the past.

Concern from both the industry and consumers

We shared the headline findings from the Big Punting Survey with representatives of both punters and the gambling operators.

The Horseracing Bettors Forum has received a huge amount of correspondence concerning the arrival of affordability checks.

"Sixteen per cent saying they've already encountered this is even higher than I would have expected and it's disappointing when there's no legal requirement," said chair Sean Trivass.

"We are getting plenty of feedback that affordability checks are something people are already struggling with. They don't want them, they don't like them. In some cases they don't want to comply on moral grounds. And that's before you get to the effort involved."

Trivass added: "We agree with the former gambling minister Paul Scully and others who have proposed some kind of soft check, something along the lines of a background credit check."

The Betting and Gaming Council's chief executive Michael Dugher also pulled no punches in his reaction to the survey's findings.

"This comprehensive survey by the Racing Post highlights a groundswell of opinion among British punters and should be a wake-up call for ministers," said Dugher.

"The message is clear: horseracing fans do not want the intrusive, blanket, low-level affordability checks that the anti-gambling lobby is calling for.

"Punters rightly object to the government or anyone else telling them how much of their own money they can afford to bet. Instead of targeting the 0.3 per cent who are problem gamblers, ministers instead risk driving customers who bet perfectly responsibly and safely to the growing unsafe, unregulated black market. They are also putting at risk the £350 million of support the regulated betting industry makes to horseracing."

Dugher added: "Once again the Racing Post is standing up for everyone – from owners and trainers to punters and racecourses – who understands that the sport faces an existential threat from so-called affordability checks. We want the white paper published without delay, but it is vital that ministers listen to grassroots racing fans.

"That's why I would urge punters to support the Racing Post but also to sign RacingTV's MP letter writing campaign, so politicians hear these concerns loud and clear before the white paper is published."

The Big Punting Survey: more key findings

Read more here:

The Big Punting Survey: revealing racing's 'Radio 4 problem'

Tom Kerr: out-of-control Gambling Commission is either clueless or treating us with contempt

Gambling Commission denies mandating the affordability checks blighting punters

Bettors urged to write to their MP with affordability checks concerns

Festival subscription offer | 50% off three months

It's festival time – get 50% off for three months! Now is the perfect time to subscribe and lock in 50% off your first three months, so you can take advantage of all the great content we've got coming up. To redeem this offer, head to the checkout and enter the code FESTIVAL23 at the payment screen to unlock your discount*. Subscribe now. Available to new subscribers purchasing Members' Club Ultimate Monthly using code FESTIVAL23. First three payments will be charged at £19.98, subscription renews at full monthly price thereafter. Customers wishing to cancel will need to contact us at least seven days before their subscription is due to renew.

Published on inGambling review

Last updated

- Labour vice-chair of parliamentary racing group calls for 'urgent action to arrest financial decline' of the sport in Britain

- 'It's costing turnover' - restrictions are forcing down online betting says professional gambler Neil Channing

- 'Teetering on the edge' - leading owner says hostility towards racing means punters and owners are falling out of love with the sport

- 'My betting is down by more than 99 per cent' - Royal Ascot-winning owner who turned over up to £1m a day bemoans impact of checks

- Letters: Gambling Commission chief executive Andrew Rhodes responds to British racing's statement

- Labour vice-chair of parliamentary racing group calls for 'urgent action to arrest financial decline' of the sport in Britain

- 'It's costing turnover' - restrictions are forcing down online betting says professional gambler Neil Channing

- 'Teetering on the edge' - leading owner says hostility towards racing means punters and owners are falling out of love with the sport

- 'My betting is down by more than 99 per cent' - Royal Ascot-winning owner who turned over up to £1m a day bemoans impact of checks

- Letters: Gambling Commission chief executive Andrew Rhodes responds to British racing's statement