- More

Ladbrokes owner Entain reports fall in online revenues as regulatory challenges continue to bite

The parent company of Ladbrokes and Coral reported that stricter regulation is continuing to hit online revenues as it updated the markets on its first quarter performance on Wednesday.

Entain said that net gaming revenue (NGR) in the UK & Ireland was down seven per cent – with online down nine per cent and retail down six per cent – "as we continue to experience the effects of our regulatory implementation".

In March Entain warned that regulatory changes in the UK and abroad such as affordability measures would continue to hit earnings in 2024 by around £40 million.

In its latest update, Entain said operational improvements together with the "levelling of the UK regulatory landscape" would position its brands for growth into 2025.

Total group NGR, including Entain's 50 per cent share in US joint venture BetMGM, was up six per cent in constant currency but down three per cent on a pro forma basis – treating the company's acquisitions last year as if they had been part of the group since the start of 2023.

Group online NGR excluding the US was down two per cent, although there had been an 11 per cent growth in active customers.

BetMGM delivered a two per cent increase in NGR in the first quarter, with the company retaining its 14 per cent share in sports betting and iGaming in the markets where it operates.

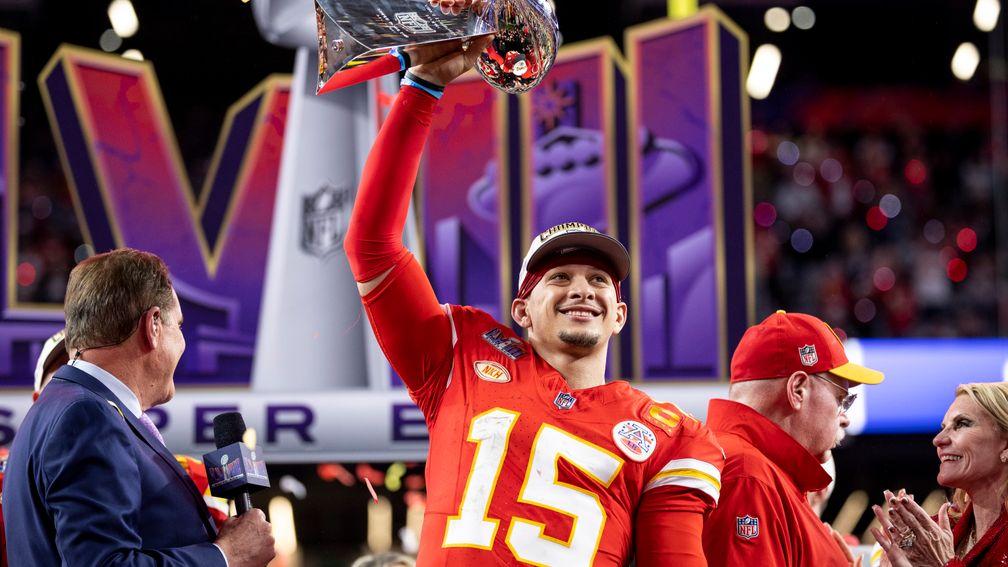

The Super Bowl and the college basketball tournament March Madness had helped produce strong growth in customer acquisition, Entain added.

Entain is searching for a new chief executive following the departure of Jette Nygaard-Andersen in December, while chairman Barry Gibson is also due to step down later this year, and is in the midst of implementing a new strategy.

Chief financial officer and deputy chief executive Rob Wood told the Racing Post results were in line with expectations, adding: "What we are focused on is delivering against the operational plan. There is an awful lot of activity at the moment and we are pleased with the progress we are making."

Wood said results had gone against them at the Cheltenham Festival in March, "but not materially so".

He added: "Cheltenham was great from a customer engagement perspective. Customer numbers were good, staking was good. Margins recovered as they often do towards the end but we still finished down a little, but that is all part of the cycle of horseracing."

The Grand National falls in the second quarter of the year, but Wood said he had been pleasantly surprised by the result despite the victory of 7-1 joint-favourite I Am Maximus.

He added: "Overall when you have 30-plus runners in a race we budget for a decent margin. We didn't reach that budget margin, but actually it was better than I thought it would be.

"Most importantly it's the engagement point again. Everybody loves watching it."

This month there was speculation private equity firms were looking to swoop amid reports Entain could sell some of its overseas brands.

Wood said: "We have engaged advisors, as has been reported, to help us conduct a review of the business and help us think through priority markets.

"There is certainly no predetermined outcome and I don't expect any outcome for many months. In the meantime we can't stop speculation but it is just exactly that, speculation."

Interim chief executive Stella David, who will take over as chair when Gibson steps down, said Entain's performance in the first quarter reflected "both strong performances in many of our markets as well as known challenges in others".

She added: "We remain confident that our continued focused execution will drive organic growth into 2025 and beyond."

David Brohan, gaming and leisure analyst at stockbrokers Goodbody, described Entain's first quarter performance as "weak", but added that it had been well flagged in advance and was "broadly in line with expectations".

Entain's closing share price on Wednesday was 814.61p, up 8.41p on the day.

Watchdog launches investigation into Spreadex-Sporting Index deal

The Competition and Markets Authority (CMA) has confirmed it will launch an in-depth 'phase two' investigation into the merger between spread betting companies Spreadex and Sporting Index.

Last week the CMA had said it was concerned the deal could remove competition for sports spread betting services.

Read these next:

Entain chairman Barry Gibson to step down in September as search for new chief executive continues

Entain admits affordability checks have been 'overly complex' for customers

The Front Runner is our unmissable email newsletter available exclusively to Members' Club Ultimate subscribers. Chris Cook, the reigning Racing Writer of the Year, provides his take on the day's biggest stories and tips for the upcoming racing every morning from Monday to Friday. Not a Members' Club Ultimate subscriber? Click here to join today and also receive our Ultimate Daily emails plus our full range of fantastic website and newspaper content.

Published on inBusiness

Last updated

- It could have been worse - but the budget heaps more pressure on British racing's leadership

- Warning that many trainers could be put out of business as British racing examines budget announcement

- William Hill parent company Evoke reports strong progress despite impact from sports results

- Betting giant Entain raises projections for the year after stronger than expected performance

- Flutter Entertainment agrees £2 billion deal to buy leading Italian operator Snaitech

- It could have been worse - but the budget heaps more pressure on British racing's leadership

- Warning that many trainers could be put out of business as British racing examines budget announcement

- William Hill parent company Evoke reports strong progress despite impact from sports results

- Betting giant Entain raises projections for the year after stronger than expected performance

- Flutter Entertainment agrees £2 billion deal to buy leading Italian operator Snaitech