New kid on the block GVC to join giants after Ladbrokes Coral deal

If anything demonstrates the rapidly changing face of the gambling industry it is the takeover of Ladbrokes Coral by GVC Holdings, which will be completed on Wednesday.

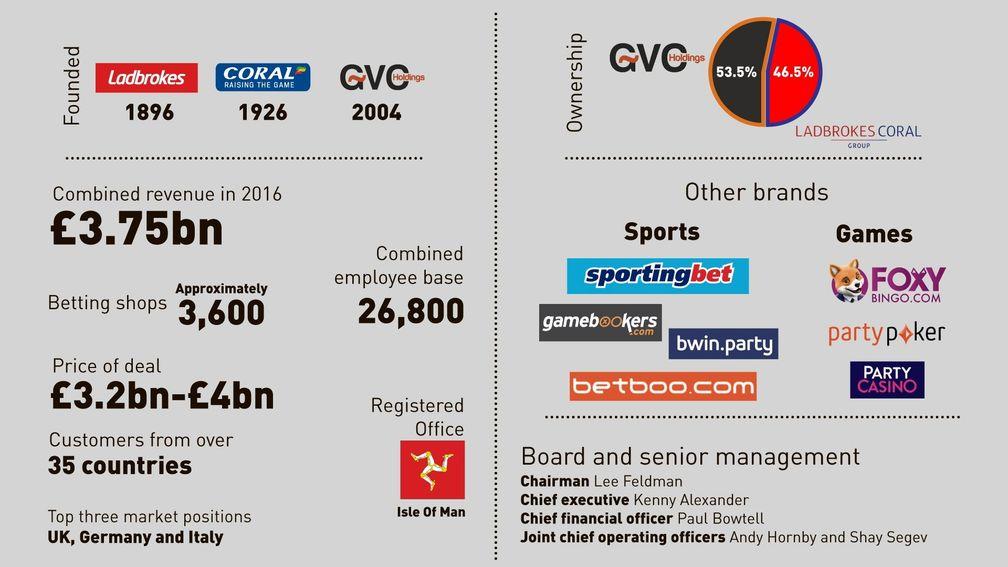

Two of the most familiar names in betting, formed in 1886 and 1926 respectively, will become part of a group which was founded only 14 years ago in Luxembourg.

The High Court gave its approval to the deal on Monday and Ladbrokes Coral will delist their shares from the London Stock Exchange on Wednesday. On Thursday GVC will issue 273 million new shares.

Led by chief executive Kenny Alexander, GVC has grown rapidly with its purchases of Sportingbet and then bwin.party propelling it into the FTSE 250.

The takeover of Ladbrokes Coral will take GVC right to the top table of gambling operators, with the prospectus for the deal describing the enlarged group as set to become "one of the largest listed sportsbook operators in the world by wagers" and "the largest listed online-led betting and gaming operator by revenue".

In all GVC will have customers from more than 35 countries and top three market positions in three of Europe's largest online gaming markets – the UK, Germany and Italy.

It will also have a significant business in Australia and a base in the US for when, as expected, sports betting becomes more widely legalised.

Analyst Gavin Kelleher of Goodbody said: "This deal creates one of largest online gambling companies globally, with significant geographical diversification."

However, not all the major deals done in the gambling industry in recent years have gone smoothly.

Integration not taken lightly

New Paddy Power Betfair chief executive Peter Jackson recently said the company had lost market share as it integrated following the merger, although GVC has pointed to its own successful integrations of Sportingbet and bwin.

Kelleher said: "GVC management have stated that the integration will be something that they will not take lightly and will incur a lot of planning. Given contractual arrangements, it is unlikely that main integration will take place until 2021."

However, Warwick Bartlett, industry veteran and chief executive and founder of the Global Betting & Gaming Consultancy believes bringing the two businesses together will not be easy.

Bartlett said: "As we have seen with previous M&A [mergers and acquisitions], expectations rarely meet performance because something always happens that management could not have possibly foreseen, and if a company is carrying a lot of debt options to manoeuvre out of problems become limited."

"These days you just need one customer horror story to put yourself in jeopardy with the Gambling Commission and a potential heavy fine, not to mention the ultimate sanction, loss of licence. While shareholders will want to see an improvement in profits, partially caused by a reduced headcount, it might be prudent to maintain numbers until management is certain compliance is efficient in all segments of the business."

Jobs set to go

GVC has said that redundancies will follow the takeover where the businesses overlap or efficiencies have been identified, with a reduction in headcount of less than six per cent of the combined group's employee base of 26,800 – around 1,600 people.

Among those leaving will be Ladbrokes Coral chief executive Jim Mullen as Alexander will head the company. Those staying on from Ladbrokes Coral include chief financial officer Paul Bowtell and joint chief operating officer Andy Hornby.

However, there could be further job losses depending on what level government decides to set FOBT stakes. The price of GVC's takeover of Ladbrokes Coral, the UK's largest betting shop operator, is on a sliding scale from around £3.2 billion at £2 up to around £4bn in the unlikely event it is £50.

In its prospectus GVC said it would consider closing betting shops which become unprofitable, adding that Ladbrokes Coral had previously said around 1,000 of their shops could close if maximum FOBT stakes were set at £2.

Regulatory pressures

The UK is not the only country in which GVC is facing regulatory uncertainty. There are questions over the legality of online gambling in Germany which provides 26 per cent of GVC's revenue, although that figure will reduce to seven per cent after the Ladbrokes Coral deal completes.

Kelleher said: "Germany is a big market for GVC and the market remains uncertain from a regulatory perspective particularly online casino and poker. However, following completion of the Ladbrokes transaction German gaming will become a significantly smaller part of the group."

Such pressures increase the likelihood of more deals taking place in the gambling industry.

"It definitely feels like there will be more consolidation in the sector," Kelleher added.

"Increased regulation and taxation appear likely, consolidation is the easiest way of mitigating the impact of both."

GVC takeover: the key questions answered

Who is GVC?

The company was incorporated in 2004 as Gaming VC Holdings SA in Luxembourg. The firm has expanded rapidly under the leadership of Kenny Alexander, completing the acquisition of much of Sportingbet in 2013 and bwin.party in 2016.

What's the thinking behind the Ladbrokes Coral deal?

The acquisition of Ladbrokes Coral gives GVC a top-three position in the huge UK market and also expands its footprint elsewhere in Europe, Australia and potentially the US. The deal also means the company has far less exposure to 'grey markets' in which gambling is not formally regulated. It also means GVC is involved in retail betting for the first time, although the deal is structured on a sliding scale so the higher the maximum on FOBT stakes, the higher the price paid.

How will it affect Ladbrokes and Coral customers?

In theory the company's greater scale and financial clout should mean better offers and value and, over time, a better product.

Why are so many deals happening in the gambling sector?

Gambling industry consolidation has been a feature across the world as operators seek to gain greater scale to protect against rising taxation and more stringent regulation.

What will the next big deal be?

All eyes will be on William Hill who have so far not been involved in the latest round of consolidation but who have been linked to a deal with Canadian gaming company The Stars Group.

Comment: GVC has form in the book but deal still a gamble

GVC Holdings chief executive Kenny Alexander has shown he is not afraid to take a gamble but his takeover of Ladbrokes Coral is his biggest punt yet.

Previous mega deals in the gambling sector have not always gone smoothly, although Alexander will point to his team's record of success in such ventures as evidence they can pull off the integration of Ladbrokes Coral too.

GVC is also entering the world of retail betting for the first time, an area about which Alexander has previously voiced misgivings.

However, he has been praised for stacking the odds in his favour by structuring the deal to reflect the possible outcomes of the government's review of FOBT stakes.

The closer the final figure is to the 'doomsday' scenario of £2, the less GVC will have to pay for Britain's largest betting shop operator.

The deal will secure GVC's arrival at the top table of the gambling industry, a remarkable rise for a firm with a much shorter history than that of Ladbrokes and Coral. It is unlikely to be the last merger or takeover to take place in the sector either, as companies come together to shelter from increased taxation and regulation.

Enjoy the daily Racing Post newspaper in full with our digital newspaper. Available to download on any device from 9pm every evening, giving you tomorrow’s paper the night before - exclusive to Members' Club Ultimate. Join here

Published on inNews

Last updated

- Join Racing Post Members' Club for the very best in racing journalism - including Patrick Mullins' unmissable trip to see Gordon Elliott

- Join the same team as Ryan Moore, Harry Cobden and other top jockeys with 50% off Racing Post Members' Club

- Racing Post Members' Club: 50% off your first three months

- 'It’s really exciting we can connect Wentworth's story to Stubbs' - last chance to catch master painter's homecoming

- The jumps season is getting into full swing - and now is the perfect time to join Racing Post Members' Club with 50% off

- Join Racing Post Members' Club for the very best in racing journalism - including Patrick Mullins' unmissable trip to see Gordon Elliott

- Join the same team as Ryan Moore, Harry Cobden and other top jockeys with 50% off Racing Post Members' Club

- Racing Post Members' Club: 50% off your first three months

- 'It’s really exciting we can connect Wentworth's story to Stubbs' - last chance to catch master painter's homecoming

- The jumps season is getting into full swing - and now is the perfect time to join Racing Post Members' Club with 50% off