Matt Hancock calls for mandatory problem gambling levy on operators

Conservative leadership hopeful Matt Hancock has said he would introduce a one per cent compulsory levy on gambling operators to pay for research and treatment to help tackle the issue of problem gambling.

The tax would raise around £100 million, ten times the amount raised from the current voluntary arrangements.

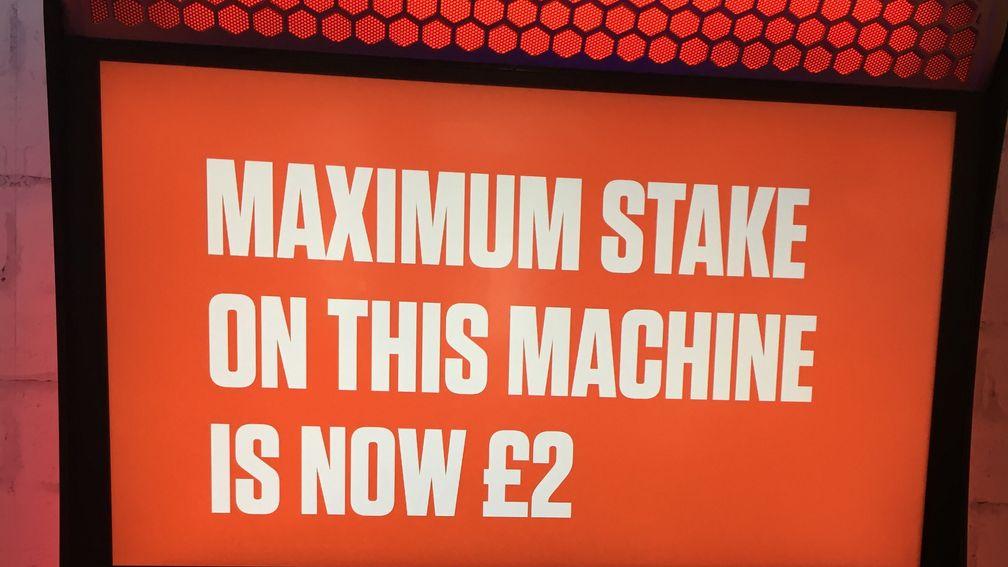

Hancock, who serves as health secretary and whose West Suffolk constituency includes Newmarket, has already made one major intervention into the gambling industry in May last year.

As culture secretary he headed the government ministry responsible for reducing FOBT stakes to £2 from £100.

He told The Sun newspaper: "I’ve seen first-hand how gambling addiction blights lives and damages our society.

"The betting industry has not taken this issue seriously enough and has failed to take enough responsibility for addressing the harm gambling causes.

"Since voluntary contributions have not worked, I will use the powers government already has to make it happen."

Under the current voluntary guidelines, gambling companies are asked to make donations to the charity GambleAware amounting to 0.1 per cent of their annual gross gambling yield, the amount operators retain after winnings have been paid out.

In the last financial year that raised £9.6m, just short of the £10m target, with GambleAware warning they expect to require a significant step-up in funding from next year.

Hancock's plans mirror those of the Labour Party, whose deputy leader Tom Watson has long advocated the introduction of a mandatory levy, while Gambling Commission chairman Bill Moyes has voiced his support for such a scheme.

However the government has so far resisted those calls.

In response to Hancock's announcement, the Remote Gambling Association said they were willing to listen to calls for extra funding depending on the evidence, but stopped well short of endorsing a mandatory levy.

The body said in a statement: "The current voluntary system is successful in raising significant funds for research, education and treatment which supplements the industry's significant tax contribution to the exchequer.

"If research suggests that there are additional needs and targeted plans to achieve them then a number of the leading gambling companies in the UK have indicated they would support these and stand ready to engage at the earliest opportunity."

If you are concerned about your gambling and are worried you may have a problem, click here to find advice on how you can receive help

Published on inNews

Last updated

- Join Racing Post Members' Club for the very best in racing journalism - including Patrick Mullins' unmissable trip to see Gordon Elliott

- Join the same team as Ryan Moore, Harry Cobden and other top jockeys with 50% off Racing Post Members' Club

- Racing Post Members' Club: 50% off your first three months

- 'It’s really exciting we can connect Wentworth's story to Stubbs' - last chance to catch master painter's homecoming

- The jumps season is getting into full swing - and now is the perfect time to join Racing Post Members' Club with 50% off

- Join Racing Post Members' Club for the very best in racing journalism - including Patrick Mullins' unmissable trip to see Gordon Elliott

- Join the same team as Ryan Moore, Harry Cobden and other top jockeys with 50% off Racing Post Members' Club

- Racing Post Members' Club: 50% off your first three months

- 'It’s really exciting we can connect Wentworth's story to Stubbs' - last chance to catch master painter's homecoming

- The jumps season is getting into full swing - and now is the perfect time to join Racing Post Members' Club with 50% off