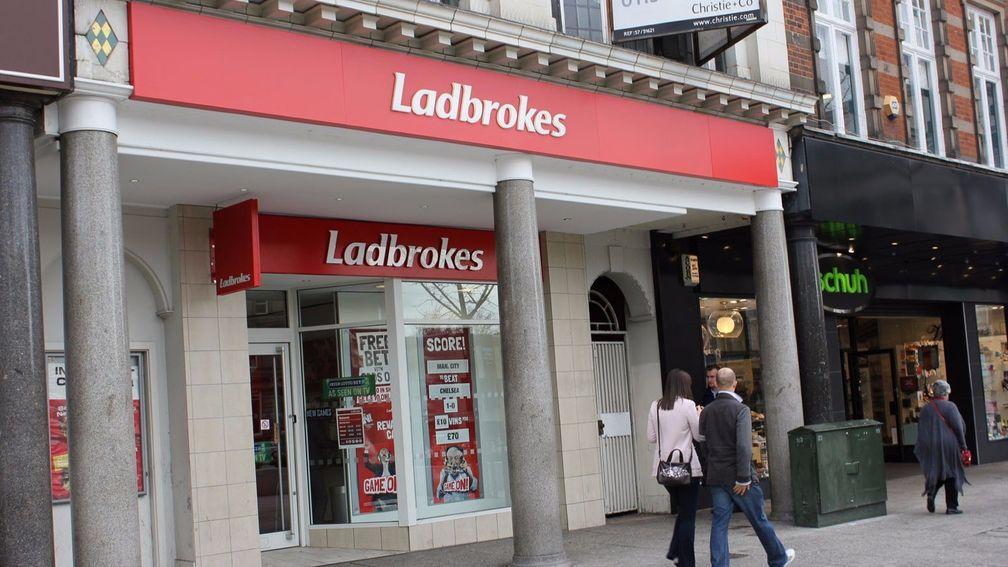

Ladbrokes back a loser in long-running £71m dispute with HMRC

Ladbrokes have lost a long-running legal battle with HM Revenue & Customs over their use of a scheme to avoid paying £71 million in tax.

The bookmakers attempted to minimise their corporation tax bill by adopting a scheme promoted in 2008 by accountants Deloitte that exploited a legal loophole that has since been closed.

It involved two companies in the Ladbrokes group, Ladbrokes International and Travel Document Service, entering into purposely designed arrangements so that an artificially manufactured fall in the value of the shares in one of the companies generated a loss for the other company for tax purposes. The group suffered no real loss overall.

A first-tier tribunal initially ruled on the case in 2015 but Ladbrokes, which conceded that the arrangements were intended to avoid tax, argued it had erred in law. The company has no outstanding tax bill as the sum has already been paid

'The bookie gambled and lost'

HMRC disagreed and judges in the upper tribunal of the Tax and Chancery chamber dismissed the appeal in a ruling published last week. Ladbrokes declined to comment.

Jennie Granger, HMRC’s director general for customer compliance, said: "Ladbrokes would have been better off just paying the tax but instead they pursued this lengthy legal dispute with HMRC.

"Avoidance schemes like this just don’t work and HMRC will always take firm action against them. The bookie gambled and lost when the odds of success could not have been lower.”

Ladbrokes was one of 11 users of the type of avoidance scheme, of which nine conceded before a tribunal hearing took place and paid the tax owed.

Published on inNews

Last updated

- Join Racing Post Members' Club for the very best in racing journalism - including Patrick Mullins' unmissable trip to see Gordon Elliott

- Join the same team as Ryan Moore, Harry Cobden and other top jockeys with 50% off Racing Post Members' Club

- Racing Post Members' Club: 50% off your first three months

- 'It’s really exciting we can connect Wentworth's story to Stubbs' - last chance to catch master painter's homecoming

- The jumps season is getting into full swing - and now is the perfect time to join Racing Post Members' Club with 50% off

- Join Racing Post Members' Club for the very best in racing journalism - including Patrick Mullins' unmissable trip to see Gordon Elliott

- Join the same team as Ryan Moore, Harry Cobden and other top jockeys with 50% off Racing Post Members' Club

- Racing Post Members' Club: 50% off your first three months

- 'It’s really exciting we can connect Wentworth's story to Stubbs' - last chance to catch master painter's homecoming

- The jumps season is getting into full swing - and now is the perfect time to join Racing Post Members' Club with 50% off