An existential threat - how did affordability checks become such a big issue?

Bill Barber with the first in a three-part series

For the last two years a sword of Damocles has been hanging over bookmakers and racing as they wait for the government to emerge from its recent turmoil and finally deliver the gambling review white paper, a document which is critical to the future of both industries.

Controversial affordability checks are likely to figure in some form as part of the government's proposals, which are finally expected to be published next month, more than two years after the review was launched.

Such checks are an attempt to prevent people spending beyond their means on gambling, something neither sector should wish to happen.

However, the intrusive way such checks have been taking place is already having a serious effect on the betting industry's revenues and, as a consequence, those of racing.

A 2019 estimate calculated racing's income from betting via the levy and media rights at £262 million a year; should intrusive checks on a punter's finances demanding proof of income, such as requests for bank statements, tax returns and P60s, become the norm for relatively low levels of spend, then the ramifications for racing could be devastating and provide an existential threat to the sport.

The level at which such checks take place varies between companies and is not often made public. In April 888, which later in the summer completed its takeover of William Hill, said its affordability check trigger was being reduced to £500 from £950, after being reduced from £2,000 in 2021.

Earlier this year there were reports the white paper contained plans for detailed checks which would take place for losses of £1,000 in 24 hours, as well as for a £2,000 net loss over 90 days, while background checks would start at £125 net loss within one month, or £500 within a year.

The gambling industry has come under increasing critical scrutiny in recent years. The so-called proliferation of betting shops and the gaming machines known as FOBTs within them was the first area to come under fire from campaigners and, when the maximum stake for those machines was reduced to £2 from £100, attention turned to issues around online gambling.

As long ago as March 2018, the Gambling Commission proposed that operators should set limits on consumers' spending online until affordability checks had been conducted.

However, concerns among British racing's leadership about the potential for the sport to become collateral damage from more draconian regulation began to grow in 2020.

During the summer of that year the Social Market Foundation (SMF), a cross-party think tank, called for the introduction of a £100 monthly 'soft cap' for net spending by online gamblers. Its lead author Dr James Noyes, a former adviser to one-time Labour deputy leader Tom Watson, said in the report: "Gamblers should be free to spend more than this threshold – but only after they show that their gambling is neither unaffordable nor harmful."

In November 2020, one month before the government's gambling review was announced, the Gambling Commission launched a consultation which included a call for evidence on what the thresholds for affordability checks should be.

A net monthly loss of £100 was mentioned as the lowest likely threshold that might prompt an affordability check, after which a customer would have to prove they could afford to lose more. The regulator might have said it was merely the lowest figure but campaigners adopted it. They have continued to call for checks to be introduced at that level.

The consultation prompted alarm throughout racing's corridors of power given the likelihood that thousands of punters would refuse to divulge such personal information and would either choose to bet through unregulated black-market channels or simply give up.

Letters sent to MPs by the racing industry in early 2021 detailed the £250m hit racecourse revenues had already suffered because of the Covid-19 pandemic and spoke of a further £60m impact per annum on the sport's revenues from lost levy and media rights payments if blanket affordability checks as low as £100 were introduced.

Indeed, other estimates put the potential damage as high as £100m a year, with six to seven out of ten punters thought likely to reject requests for information.

The issue aroused unprecedented interest, with the Gambling Commission receiving a record response to one of its consultations of more than 13,000 replies. However, its findings are still awaited.

The government's review had acknowledged the Gambling Commission's consultation but had also asked for evidence on whether controls on gambling accounts should include deposit, loss and spend limits and whether such limits should be "targeted at individuals based on affordability or other considerations".

The government's call for evidence received 16,000 responses by the time it closed in March 2021 and it was expected that the resulting white paper would be published by Christmas of that year.

Another 12 months on it has still not appeared, delayed not only by the complexity of the issues involved but also by the churn of personnel at the Department for Digital, Culture, Media and Sport (DCMS) – there have been five gambling ministers since the review was launched – and the turmoil at 10 Downing Street this year which has seen the departures of both Boris Johnson and Liz Truss as prime minister.

Reports have actually suggested the government favours what have been described as 'non-intrusive' procedures akin to a credit check, although the subject is likely to be the subject of a further consultation.

But in the vacuum left by the delay to the white paper, affordability checks have already started to be introduced by bookmakers, with customers being asked to provide personal financial information in order to continue to bet, despite the government not having set out its proposals.

And although the government, Gambling Commission and campaigners have discussed affordability checks only in the online sphere, customers have also reported being asked for such information in betting shops.

The Gambling Commission claims not to have asked operators to do so but operators say they have been left with little choice given the ambiguity in the regulator's advice, which is leading them to take a precautionary approach for fear of regulatory punishment.

The commission has been ramping up its punishments for those found to have broken rules around interactions with problem gamblers and anti-money laundering conditions, hitting Ladbrokes and Coral owner Entain with a record £17m fine in August.

When asked what sort of information it wants operators to ask customers for, the Gambling Commission told the Racing Post: "Financial distress is one of the harms most closely associated with gambling harm, therefore operators should always have been considering financial risk when considering harm for consumers.

"The commission hasn't yet introduced any specific requirements on operators about how they should do this. Operators have developed the current approaches to manage the risk in this area.

"Because the industry hasn't done this effectively or consistently, we have indicated our proposals to introduce specific requirements in this area. We will consult on these separately next year."

However, it would not be true that the commission has not specifically mentioned requests for personal financial information in the past. Those came in its report on Compliance and Enforcement Action 2019 to 2020, published in November 2020 and last updated a year ago.

In the section titled Triggers and Customer Affordability, the commission said: "Operators must interact with customers early on to set adequate, informed affordability triggers to protect customers from gambling-related harm. Failure to do so could render the operator non-compliant.

"Customers wishing to spend more than the national average should be asked to provide information to support a higher affordability trigger such as three months' payslips, P60s, tax returns or bank statements."

That section also told operators they should consider each customer's discretionary income when deciding on affordability triggers.

It could well be argued that the commission is overstepping its remit and does not have the mandate to infringe on the liberties of the vast majority of customers who do not suffer harm from gambling.

During the summer David Whyte, a gambling industry specialist with law firm Harris Hagan, told the Racing Post that affordability checks pose constitutional and personal rights questions which fall outside the regulator's remit. "This is for parliament to decide, not the Gambling Commission," he said.

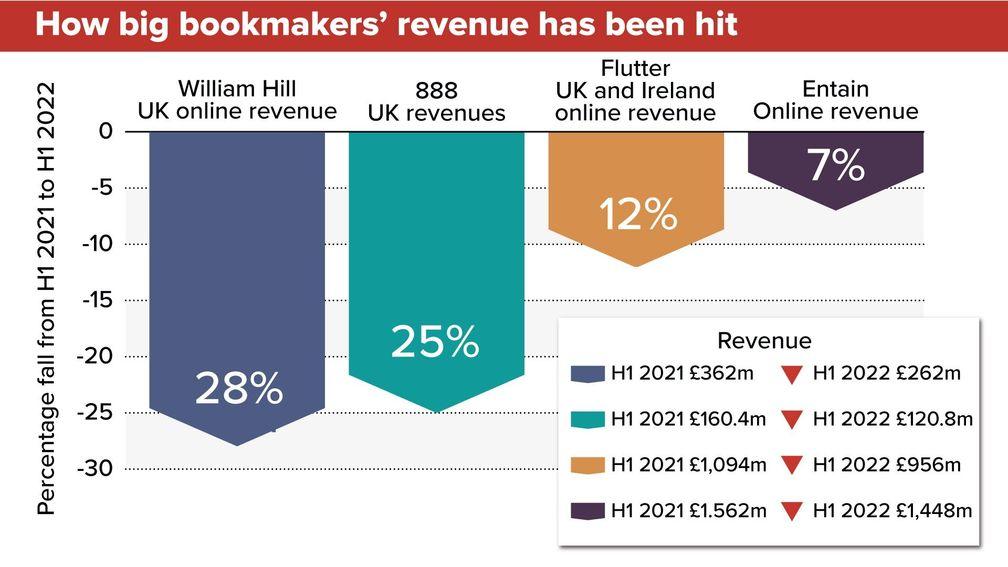

The consequences of the checks that are already in place have been laid out in betting companies' recent financial results, which were summarised by Gambling Commission chief executive Andrew Rhodes in a speech to industry chief executives late last month.

"A number of the largest operator groups – some sat in this room – are stating revenues are down due to safer gambling measures they are introducing in terms of stake limits and affordability measures they have taken," he said.

When 888, which is one of those large operators, announced a seven per cent year-on-year drop in revenue in its third-quarter trading update in October, its chief executive Itai Pazner said there was "continued pressure on our UK online revenues in light of the ongoing impact of the enhanced player safety measures".

Phil Walker, 888's managing director for the UK, told the Racing Post: "What we've said all along is that what we want is consistent regulation and a level playing field, and the white paper to represent that. We are very keen to see the detail of the white paper as soon as possible.

"I think what has happened up to this point hasn't really been consistent for operators or for customers and that's a very difficult environment.

"Up to this point, clearly we have invested very heavily in player safety measures to anticipate where future regulation of the white paper may end up, and those player safety measures have had a significant impact on revenues overall."

When gambling minister Paul Scully addressed the GambleAware Conference in London this month, he did not touch on the subject of affordability directly. However, he did say gambling regulation should be "fair and proportionate" and that it should work "for the large number of people who gamble without experiencing harm".

Such words should come as some comfort to bookmakers and their representatives. Betting and Gaming Council chief executive Michael Dugher acknowledged ministers have a minefield to negotiate when it comes to affordability.

"The government has engaged with a genuinely evidence-based process up to now but they do realise that putting in an affordability framework is tricky," he said.

"What we have said to them is we are not against enhanced spending checks online; indeed, many operators have made huge progress in that area. We just think the answer to this is technology, and we need to use technology to make sure you are targeting actions and interventions on problem gamblers and those showing markers of harm."

Dugher said operators use "dozens and dozens of markers of harm" when monitoring people's play, such as whether they are betting more than they usually do, betting at unusual times of the day or chasing losses, and as a result can intervene.

He added: "What we are saying is, given that problem gambling is 0.3 per cent, the vast majority of punters bet responsibly and safely, you need to leave those people alone and make sure you use the technology to target these kinds of checks to problem gamblers and the vulnerable and leave everybody else alone.

"We've talked to the government about how they might do this. We are not anti-affordability checks, we just believe they should be proportionate and very carefully targeted to the vulnerable and to the tiny minority of customers who show markers of harm."

When asked how the Gambling Commission would respond once the white paper does appear, the regulator said it would consult on three "key financial risks" – binge gambling, unaffordable losses over a sustained period and customers who are "particularly financially vulnerable" – and what thresholds should apply.

"We have been working closely with DCMS and will take into account the context of the government's white paper for this consultation," the commission added.

The difficulty in trying to find a way of introducing affordability checks which protect the vulnerable but which allow the vast majority of punters to continue betting without intervention is believed to be one of the reasons for the white paper's continued delay.

There are concerns among operators that ministers who have said they want the white paper "out of the door" will instead pass the buck to the Gambling Commission through the mooted consultation which will follow the white paper's publication.

That could allow the more intrusive checks which are already taking place, with or without the regulator's encouragement, to continue.

And those concerns will also be felt within the British racing industry, whose fears that punters will be put off by such checks are being realised.

Read more from this series:

Part two: 'I'm very close to giving up' - the punters suffering from affordability checks

Part three: The £40 million blow - how affordability checks are already hitting horseracing

The Front Runner is our latest email newsletter available exclusively to Members' Club Ultimate subscribers. Chris Cook, a four-time Racing Reporter of the Year award winner, provides his take on the day's biggest stories and tips for the upcoming racing every morning from Monday to Friday. Not a Members' Club Ultimate subscriber? Click here to join today and also receive our Ultimate Daily emails plus our full range of fantastic website and newspaper content

Published on 13 December 2022inSeries

Last updated 11:35, 16 December 2022

- We believed Dancing Brave could fly - and then he took off to prove it

- 'Don't wind up bookmakers - you might feel clever but your accounts won't last'

- 'There wouldn't be a day I don't think about those boys and their families'

- 'You want a bit of noise, a bit of life - and you have to be fair to punters'

- 'I take flak and it frustrates me - but I'm not going to wreck another horse'

- We believed Dancing Brave could fly - and then he took off to prove it

- 'Don't wind up bookmakers - you might feel clever but your accounts won't last'

- 'There wouldn't be a day I don't think about those boys and their families'

- 'You want a bit of noise, a bit of life - and you have to be fair to punters'

- 'I take flak and it frustrates me - but I'm not going to wreck another horse'